Súťaž o bankových klientov je súbojom takmer bez pravidiel. Jedno pravidlo je ale univerzálne platné – tento boj je extrémne finančne náročný. Získanie klienta z konkurenčnej banky si dnes vyžaduje investície do masívnej reklamy, do substituovaných produktov či priamo finančnej motivácie k prestupu.

Odpoveďou bankových inovátorov nie je pokračovanie v tomto nekonečnom súboji, ale presunutie pozornosti na iné klientské segmenty. Podchytenie klienta v detskom veku a aktívna práca na zvyšovaní jeho lojality sa dnes javí ako podstatne užitočnejšia (a lacnešia!) cesta k profitabilnému klientovi, než len veľmi prácne získavanie klientov z iných bánk.

“Detské bankovanie” učí klientov od útleho veku, že bankové služby sú súčasťou ich životov, pripravuje ich k využívaniu širokej škály produktov v budúcnosti a zároveň zvyšuje toľko skloňovanú finančnú gramotnosť.

Poskytovanie detských účtov, detských sporení alebo predplatených kariet prepojených s rodičovskými účtami je cesta, ako sa využívanie bankových služieb môže stať súčasťou rodinných aktivít. Najmladšia generácia prirodzene preferuje “mobile first” prístup, čo sekundárne zvyšuje aj digitálnu gramotnosť vlastných rodičov a ich postupný prechod na čoraz väčšie využívanie služieb internet-, respektíve mobile-bankingu.

Value proposition je nasledovná:

Učenie zodpovednosti

S platobnou kartou a účtom dieťa získava pocit zodpovednosti a nástroj na sledovanie pohybu svojich peňazí

Odmeny za úlohy a domáce práce

V rodičovskej aplikácií je možné definovať domáce práce alebo školské úlohy, ktorých úspešné dokončenie je odmenené finančnou odmenou od rodiča.

Pravidelné vreckové

Dedikované aplikácie a Internet banking poskytujú možnosť nastaviť pravidelné pripisované vreckového na účet dieťaťa.

1Finančné vzdelávanie

Deti sa potrebujú naučiť o hodnote peňazí a ako s nimi narábať. Atraktívne interaktívne aplikácie učia deti hravou formou ako si sporiť, či sledovať si svoje drobné výdavky.

Bezpečnosť

Minimalizácia rizika straty hotovosti a nastavenie limitov na platbu kartou, mobilom a výbery hotovosti.

Rodičovská kontrola

Rodič má možnosť sledovať, na čo jeho dieťa míňa peniaze a ako sa mu darí sporiť. V ďalšom stupni umožní napríklad aj nastavenie limitov na kategórie detských výdavkov.

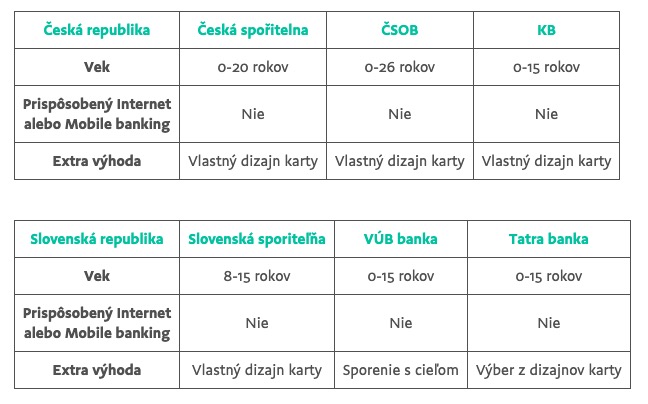

Je zaujímavé, že v tejto oblasti zatiaľ dopyt zo strany mladých klientov a ich rodičov nie je plnohodnotne zohľadnený ponukou bankových produktov. V Českej a Slovenskej republike existuje doposiaľ len veľmi obmedzený rozsah špecializovaných detských bankových produktov.

Poskytovanie bežných účtov pre juniorných klientov možno stačilo pred desiatimi rokmi, ale inovatívne sporiace produkty, prispôsobenie internet-bankingu alebo dedikovaná mobile-banking aplikácia pre detských klientov v ponuke bánk stále chýbajú.

Přehled vybraných dětských bankovních produktů:

Zajímavý pohled určitě nabídne překročení našich hranic a analýza nabídek bank v zahraničí – zde je několik z nich:

PKO BANK – Poľsko

- Mobilné “dobíjanie” peňazí

- Nastavenie cieľov a sporení

- Odmeny a odznaky za dobré výsledky v škole a domáce práce

- Schvaľovanie transakcií dieťaťa

RABOBANK – Holandsko

- Sporiaci účet pre deti s úročením

- Nastavenie cieľov

- Mini hry s viruálnou menou

- Zarábanie virtuálnych peňazí za dobré známky a domáce práce

Revolut Junior – Spojené kráľovstvo / Litva

- Predplatená karta

- Možnosť tvorby rozpočtu na týždenné vreckové

- Odmeny za vykonané domáce práce

- Upozornenia na minuté peniaze v reálnom čase

Kard – Francúzsko

- Poistenie smartfónu

- Prepojenie so sociálnymi sieťami

- Blokovanie vybraných obchodníkov

ZAAP – Austrália

- Predplatená karta

- Vlastný dizajn karty alebo ZAAP náramok

- Rodičovská kontrola

RABOBANK – Holandsko

- Sporiaci účet pre deti s úročením

- Nastavenie cieľov

- Mini hry s viruálnou menou

- Zarábanie virtuálnych peňazí za dobré známky a domáce práce

Kard – Francúzsko

- Poistenie smartfónu

- Prepojenie so sociálnymi sieťami

- Blokovanie vybraných obchodníkov

Roostermoney – USA

- Prispôsobiteľný dashboard pre deti

- Nastavenia sporenia s fotografiami

- Sledovanie domácich prác s odmenami

- Motivovanie detí k sporeniu

Zajímavý pohled určitě nabídne překročení našich hranic a analýza nabídek bank v zahraničí – zde je několik z nich:

Greyson Consulting už 15 rokov prináša bankové inovácie, ktoré pomáhajú našim klientom úspešne rásť.

Zaujímajú aj Vás nové trendy v bankovníctve a poisťovníctve? Radi si s Vami prejdeme príležitosti aj vo Vašej spoločnosti.